How Credit Card Limits Are Determined

How Credit Card Limits Are Determined: Everything You Need to Know

When you apply for a credit card, one of the first things you’ll notice after approval is your credit limit — the maximum amount you’re allowed to spend on that card. But how do banks decide this number? Why do some people get a $1,000 limit while others get $20,000 or more?

In this post, we’ll break down exactly how credit card issuers determine your limit, what factors influence it, and how you can increase your credit line over time.

1. What Is a Credit Card Limit?

Your credit card limit is the maximum balance you can carry on your credit card at any given time. It affects not only how much you can spend but also your credit utilization ratio, which in turn impacts your credit score.

For example, if your limit is $5,000 and you spend $2,500, your utilization rate is 50%. Experts recommend keeping it under 30% to maintain a healthy credit profile.

2. Key Factors That Determine Your Credit Limit

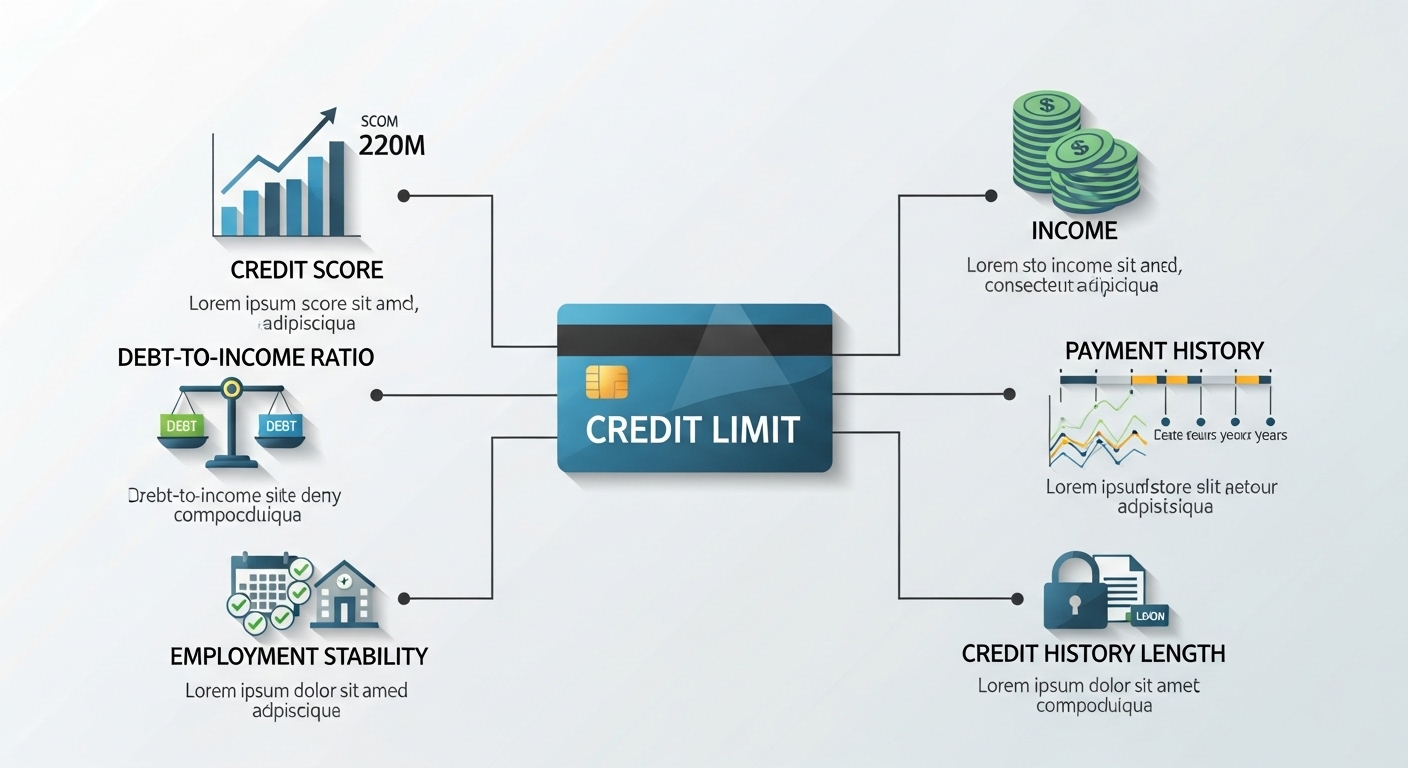

Banks and credit card companies rely on a variety of data points to decide your limit. Here are the most important ones:

a. Credit Score

Your credit score is one of the biggest factors. A higher score suggests responsible borrowing and repayment behavior, leading to a higher limit.

- Excellent (750–850): May qualify for premium cards and high limits.

- Good (700–749): Often receive mid-range limits.

- Fair or Poor (below 700): May start with a lower limit until trust is built.

b. Income Level

Your annual or monthly income is another crucial component. Card issuers use this information to estimate how much debt you can handle comfortably.

The higher your income, the greater your potential limit — but it also depends on your existing financial obligations.

c. Debt-to-Income Ratio (DTI)

Even if you earn a high income, having a lot of existing debt can reduce your available credit line.

Issuers typically prefer a DTI below 36%, meaning your total monthly debt payments should be less than 36% of your income.

d. Payment History

Lenders love consistency. If you’ve been paying bills and existing credit cards on time, you’re seen as a lower risk.

Late payments or defaults, on the other hand, can result in a lower initial limit or even a denial.

e. Existing Relationship with the Bank

If you’re an existing customer with a positive account history — such as a long-term savings or checking account — banks may reward you with a higher limit based on your proven reliability.

f. Type of Credit Card

Different cards target different segments.

- Entry-level or student cards: Typically start with low limits ($300–$1,000).

- Mid-tier cards: Offer moderate limits ($2,000–$5,000).

- Premium or rewards cards: Can provide limits above $10,000, depending on your profile.

3. How Credit Card Issuers Set the Limit

The process usually involves a credit risk assessment model, which combines the above factors into a score or rating. Based on this analysis, the issuer decides your creditworthiness and assigns a limit accordingly.

Some issuers also perform a soft pull to estimate a limit before approval, while others finalize it only after a hard credit check.

4. Can You Increase Your Credit Limit?

Yes — and doing so responsibly can boost your credit score over time. Here are a few ways:

- Request a Credit Limit Increase: Most issuers let you apply for a higher limit after 6–12 months of on-time payments.

- Improve Your Credit Score: Pay bills on time, reduce debt, and avoid applying for too many new accounts.

- Update Your Income Information: If your income rises, report it to your issuer — this often qualifies you for a higher limit.

- Use the Card Responsibly: Regular use combined with timely full payments builds lender trust.

5. What Happens If You Exceed Your Credit Limit?

Some cards may allow you to go over your limit, but you could face over-limit fees or a temporary credit freeze. Additionally, exceeding your limit can negatively affect your credit utilization ratio, which might lower your credit score.

6. Final Thoughts

Your credit card limit isn’t random — it’s a calculated decision based on your financial behavior, income, and credit history. Understanding these factors helps you not only predict your potential limits but also manage your credit more strategically.

If you handle your credit card responsibly, pay on time, and maintain a low utilization rate, you’ll likely see your limit — and financial opportunities — grow over time.