What to Consider When Applying for a Credit Card

Applying for a credit card can be an important financial step — one that offers convenience, flexibility, and the opportunity to build your credit history. However, choosing the right card and understanding the terms are crucial to avoid potential pitfalls. Here are the key factors you should consider before submitting your credit card application.

1. Understand Your Financial Needs

Before applying, ask yourself why you need a credit card. Are you looking to build credit, earn rewards, or manage daily expenses more easily? Identifying your goals will help you select a card that matches your lifestyle — for example, a low-interest card for balance transfers, or a rewards card for frequent travelers.

2. Check Your Credit Score

Your credit score plays a major role in determining your eligibility and the terms you’ll receive. A higher score typically leads to better interest rates and higher credit limits. Review your credit report for any errors and try to improve your score before applying.

3. Compare Interest Rates (APR)

The Annual Percentage Rate (APR) represents how much you’ll pay in interest if you carry a balance. Some cards offer low introductory APRs, which can rise after a certain period. Always read the fine print and understand the long-term rate.

4. Evaluate Fees and Charges

Credit cards often come with various fees — annual fees, late payment fees, foreign transaction fees, and cash advance fees. Make sure to review all costs associated with the card and determine if the benefits outweigh the expenses.

5. Look at Rewards and Benefits

If you plan to use your credit card regularly, choose one that offers valuable rewards. Some cards offer cashback, while others provide travel points or discounts. Be sure the reward structure aligns with your spending habits so you can truly benefit.

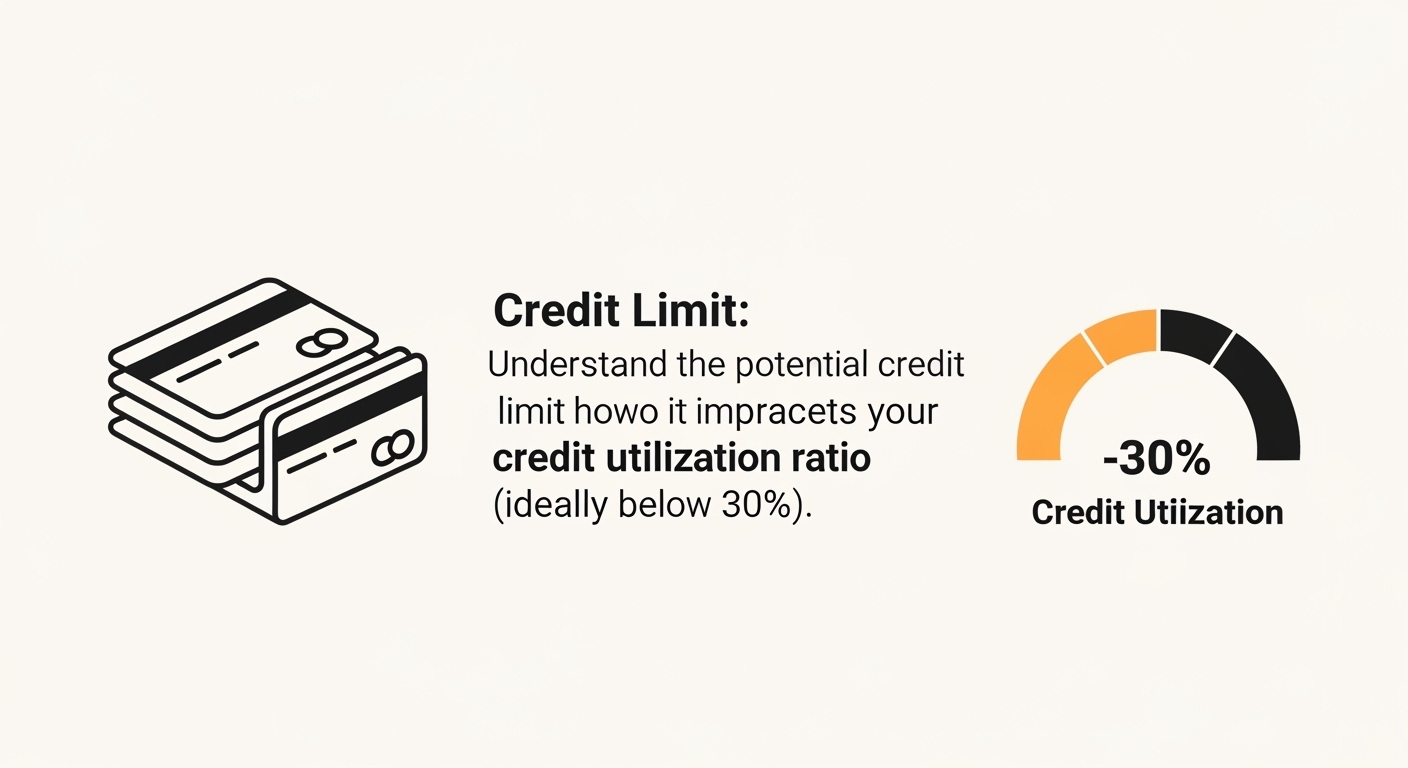

6. Understand the Credit Limit

Your credit limit is the maximum amount you can borrow. While a higher limit can improve your credit utilization ratio (and thus your credit score), it also requires discipline to avoid overspending. Choose a limit that suits your financial capacity.

7. Read the Terms and Conditions Carefully

Always take the time to read the card’s terms and conditions. Pay attention to clauses about interest rate changes, reward expiration dates, and penalties for late payments. Understanding these details can save you from unexpected costs.

8. Consider Customer Service and Bank Reputation

A card from a reputable financial institution with strong customer support can make a big difference. You’ll want responsive service in case of disputes, fraud, or billing errors.

Final Thoughts

A credit card can be a powerful financial tool when used wisely. By carefully evaluating your options and understanding the terms, you can choose a card that fits your financial goals and helps you build a healthy credit profile.