What Is a Credit Card Statement and How to Read It?

Every month, your credit card issuer sends you a credit card statement — a detailed summary of your account activity, including purchases, payments, interest charges, and fees. Understanding this document is essential for managing your finances, avoiding debt, and protecting yourself from fraud.

In this guide, we’ll explain what a credit card statement is, break down each section, and show you how to read it effectively.

What Is a Credit Card Statement?

A credit card statement (also known as a billing statement) is a monthly report that provides a record of all transactions made with your credit card during a specific billing cycle.

It includes:

- The total balance you owe,

- The minimum payment required,

- The due date, and

- A summary of all charges and payments.

Your statement helps you track your spending, monitor interest and fees, and ensure there are no unauthorized transactions on your account.

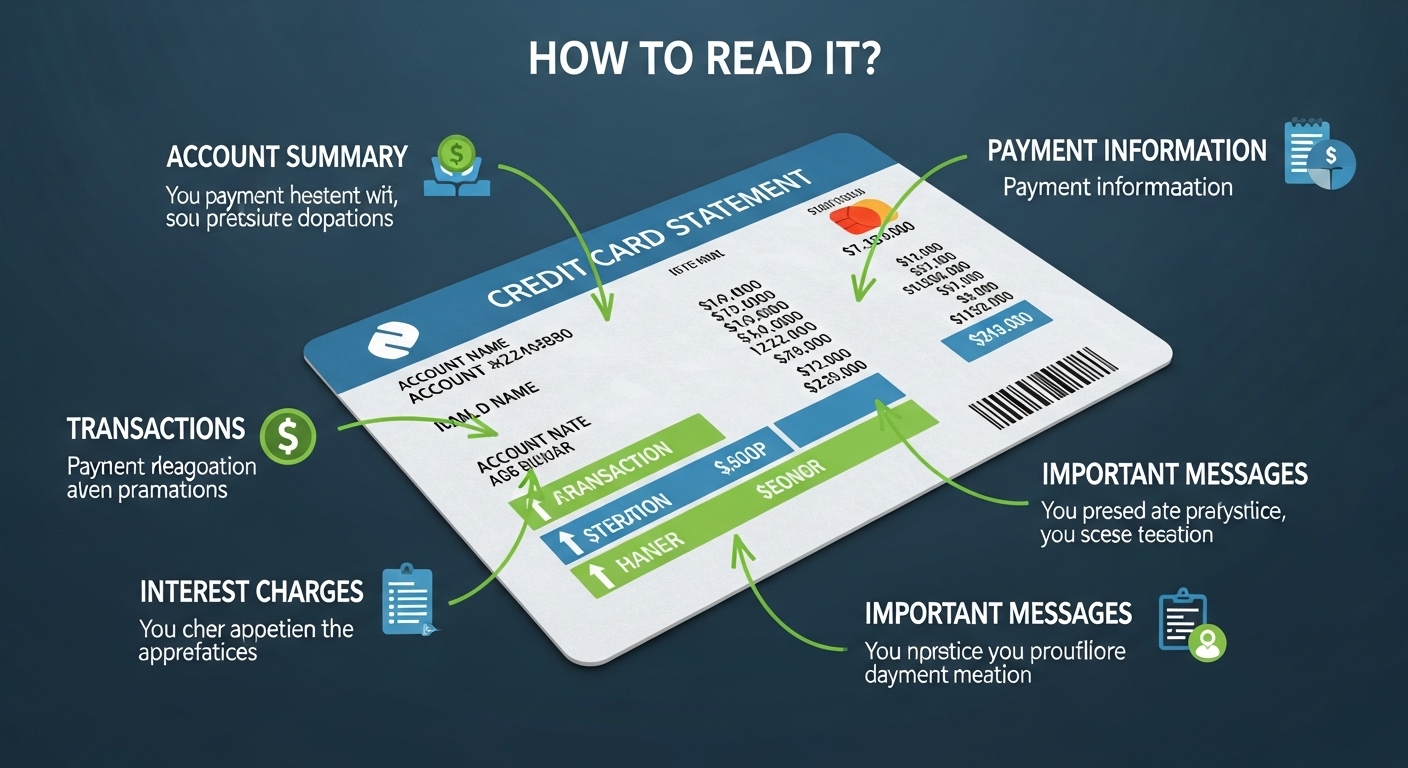

Key Sections of a Credit Card Statement

While layouts vary by issuer, most credit card statements include the following sections:

1. Account Summary

This section gives you a snapshot of your account for the current billing cycle. It typically includes:

- Previous balance: What you owed at the end of the last billing cycle.

- Payments and credits: Any payments or refunds credited to your account.

- Purchases: Total amount spent during the current cycle.

- Fees and interest: Any additional charges, such as annual fees or interest.

- New balance: Your total amount due.

2. Payment Information

This section shows crucial details about what you need to pay and when:

- Minimum payment due: The smallest amount you must pay to keep your account in good standing.

- Payment due date: The deadline to make your payment. Missing it can lead to late fees and interest.

- Total balance: The full amount you owe. Paying this avoids interest on new purchases (if you had no previous balance).

3. Credit Limit and Available Credit

This tells you:

- Credit limit: The maximum amount you can borrow.

- Available credit: How much credit remains after your current balance.

Monitoring this helps you stay within your limit and maintain a healthy credit utilization ratio (preferably under 30%).

4. Transactions List

Here you’ll find a detailed list of every transaction made during the billing cycle, including:

- Purchases at stores or online retailers.

- Cash advances.

- Balance transfers.

- Payments and credits.

Each transaction typically includes the date, merchant name, and amount. Always review this section carefully to spot any suspicious activity.

5. Interest Charges and Fees

If you don’t pay your balance in full by the due date, you’ll be charged interest on the remaining amount. Your statement will show:

- Interest charged for the period.

- Annual Percentage Rate (APR) for different transaction types (purchases, cash advances, balance transfers).

- Any applicable fees such as late payment, over-limit, or foreign transaction fees.

6. Rewards Summary (if applicable)

If your card offers rewards, this section shows:

- Points or cashback earned during the billing cycle.

- Points redeemed or expired.

- Total rewards balance.

How to Read and Understand Your Statement

To make the most of your credit card statement, follow these steps:

- Check your personal and account information – Ensure your name, address, and account number are correct.

- Review all transactions – Verify that every charge is legitimate. Report unauthorized transactions immediately.

- Look at your minimum payment and due date – Pay at least the minimum by the due date to avoid penalties.

- Understand your interest rates (APR) – Different types of transactions may have different rates.

- Track your spending habits – Use the summary to see where your money goes each month.

Why Reading Your Credit Card Statement Matters

Ignoring your statement can lead to serious financial issues. Here’s why it’s important to review it regularly:

- Avoid late payments: Prevent unnecessary fees and credit score damage.

- Catch fraudulent charges: Detect unauthorized transactions quickly.

- Manage your debt: Stay aware of how much you owe and your repayment progress.

- Optimize rewards: Keep track of your reward points or cashback.

- Understand your spending patterns: Helps with budgeting and financial planning.

Tips for Managing Your Credit Card Statement

- Set up automatic payments to avoid missing due dates.

- Pay in full whenever possible to avoid interest charges.

- Download digital statements to keep records safely.

- Use alerts to get notifications for new transactions or when your payment is due.

- Compare statements monthly to track changes in spending or fees.

Final Thoughts

Your credit card statement isn’t just a piece of paper — it’s a financial tool that helps you stay informed, organized, and in control. By learning how to read and understand it, you can manage your credit responsibly, protect yourself from fraud, and build a stronger financial future.