How to Calculate Credit Card Interest

Credit cards are convenient tools for everyday spending, but when you carry a balance, interest charges can add up quickly. Understanding how credit card interest is calculated helps you make smarter financial decisions, avoid costly surprises, and manage your debt effectively.

In this article, we’ll break down what credit card interest is, how it’s calculated, and how you can minimize it — step by step.

What Is Credit Card Interest?

Credit card interest is the cost of borrowing money from your credit card issuer. Whenever you don’t pay your full balance by the due date, the remaining amount carries over to the next billing cycle, and interest starts accumulating.

This interest is based on your card’s APR (Annual Percentage Rate) — the yearly rate your bank charges for borrowing.

Key Terms You Need to Know

Before calculating credit card interest, it’s important to understand a few basic terms:

- APR (Annual Percentage Rate):

The yearly interest rate expressed as a percentage (e.g., 20% APR). - Daily Periodic Rate (DPR):

The interest rate your issuer applies daily.

It’s calculated as:

[

\text{DPR} = \frac{\text{APR}}{365}

] - Average Daily Balance (ADB):

The average amount you owe on your card each day during the billing cycle. - Billing Cycle:

The number of days in your credit card statement period (usually 28–31 days).

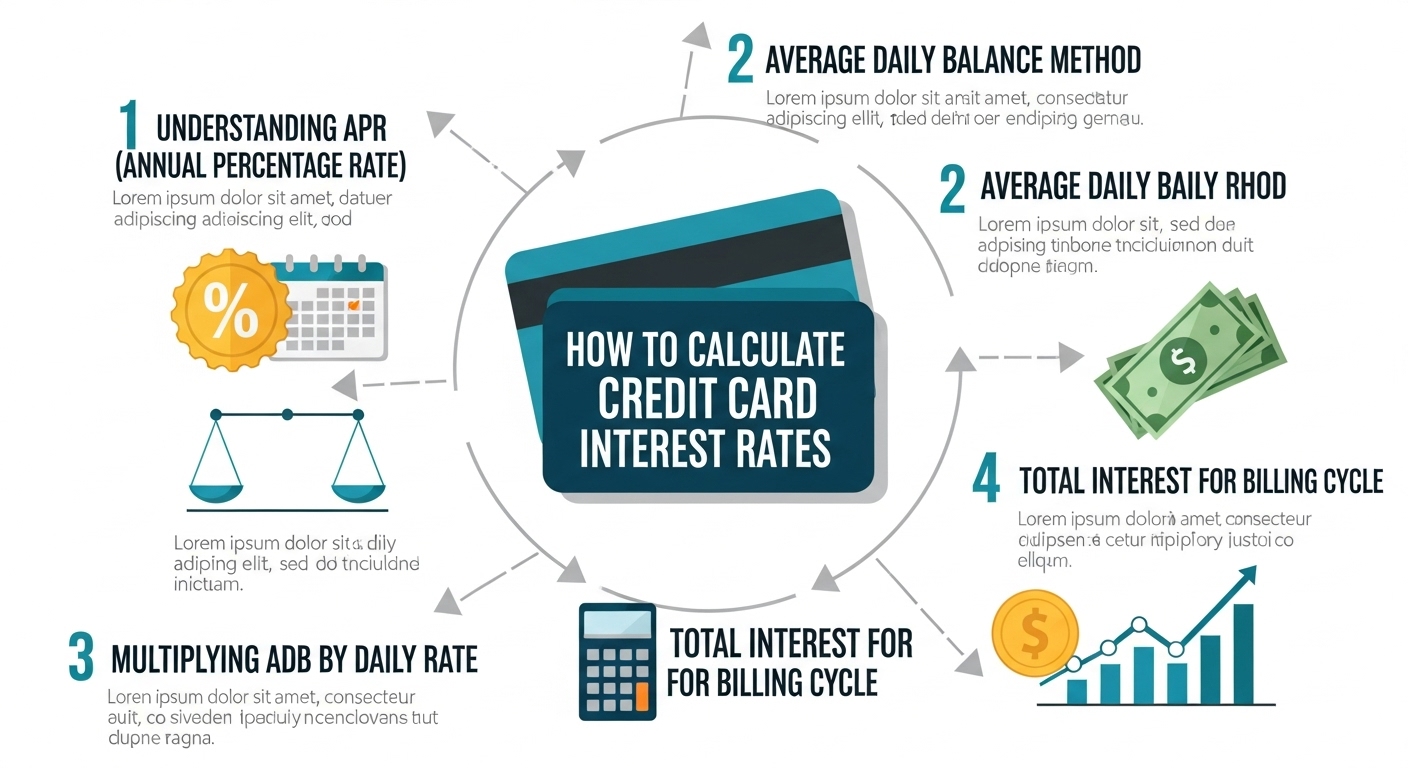

How to Calculate Credit Card Interest Step by Step

Let’s go through the process with an example.

Step 1: Find Your APR

You can find your card’s APR on your statement or the credit card issuer’s website.

Let’s assume your APR is 20%.

Step 2: Convert APR to Daily Periodic Rate

Divide the APR by 365 (days in a year):

[\text{DPR} = \frac{20%}{365} = 0.0548% \text{ per day}

]

Step 3: Determine Your Average Daily Balance

To find your Average Daily Balance (ADB):

- Add up your balance for each day of the billing cycle.

- Divide that total by the number of days in the cycle.

Example:

If your balances over 30 days average out to $1,000, then your ADB is $1,000.

Step 4: Multiply to Find Monthly Interest

Now multiply your DPR × ADB × Number of Days in Billing Cycle:

[\text{Interest} = 0.000548 \times 1,000 \times 30 = $16.44

]

So, your monthly interest charge would be approximately $16.44.

Example Summary

| Factor | Value |

|---|---|

| APR | 20% |

| Daily Periodic Rate | 0.0548% |

| Average Daily Balance | $1,000 |

| Billing Cycle | 30 days |

| Monthly Interest Charge | $16.44 |

How Credit Card Interest Actually Works

Credit card companies typically use the Average Daily Balance (ADB) method to calculate interest.

This means they:

- Track your balance daily (including new purchases and payments).

- Multiply the balance by your daily rate.

- Sum up those charges for the entire billing cycle.

That’s why carrying a balance, even for a few days, can increase your total interest cost.

Grace Periods and When Interest Starts

Most credit cards offer a grace period, usually between 21–25 days.

If you pay your full balance within this period, you pay no interest on purchases.

However, if you carry a balance, new purchases may start accruing interest immediately — unless you pay off the full amount again to reset your grace period.

Factors That Affect Credit Card Interest

Several elements influence how much interest you’ll pay:

- Your APR Type:

- Fixed APR: Stays the same (unless your issuer changes it with notice).

- Variable APR: Changes based on market rates (like the Prime Rate).

- Your Payment Habits:

- Paying late can increase your interest rate (penalty APR).

- Making only minimum payments keeps your balance high longer.

- Promotional Rates:

- Many cards offer 0% introductory APR for a limited time.

After that period, regular interest applies to remaining balances.

- Many cards offer 0% introductory APR for a limited time.

How to Reduce or Avoid Paying Credit Card Interest

Here are some practical tips to keep interest charges low — or eliminate them entirely:

1. Pay Your Balance in Full

The simplest way to avoid interest is to pay your full statement balance every month before the due date.

2. Make Multiple Payments

Paying more than once a month lowers your average daily balance, reducing interest charges.

3. Take Advantage of 0% APR Offers

If you have existing debt, a balance transfer card with 0% interest for 12–21 months can help you pay off faster.

4. Negotiate a Lower APR

If you’ve been a loyal customer with good payment history, call your issuer and ask for a lower rate.

5. Improve Your Credit Score

Higher credit scores often qualify for better interest rates. Paying bills on time and keeping utilization low helps.

Example: How Payments Affect Interest

| Scenario | Balance | APR | Interest per Month |

|---|---|---|---|

| Pay Full Balance | $0 | 20% | $0 |

| Pay Half Balance | $500 | 20% | ~$8.22 |

| Make Only Minimum Payment | $1,000 | 20% | ~$16.44 |

Even small extra payments can significantly cut down interest costs over time.

Final Thoughts

Credit card interest might seem complicated, but once you understand the math, it’s completely manageable.

To recap:

- Divide your APR by 365 to find your daily rate.

- Multiply it by your average daily balance and billing days.

- And remember — paying your balance in full is the best way to avoid interest altogether.

By learning how to calculate credit card interest, you’ll make smarter payment decisions and stay in control of your finances.

Summary Table

| Step | Description | Formula |

|---|---|---|

| 1 | Find APR | From your statement |

| 2 | Convert to Daily Rate | APR ÷ 365 |

| 3 | Find Average Daily Balance | (Sum of daily balances ÷ days in cycle) |

| 4 | Calculate Interest | DPR × ADB × Days |