Credit Card Debt Payoff Strategies

Smart Strategies to Pay Off Credit Card Debt Faster

Credit card debt is one of the most common financial challenges people face today. With high interest rates and tempting spending limits, it’s easy to fall into the debt trap — and hard to climb out.

The good news? Paying off credit card debt doesn’t have to feel impossible. With the right strategies, discipline, and mindset, you can take control of your finances, reduce your debt faster, and regain your financial freedom.

In this guide, we’ll explore the best, proven strategies to pay off credit card debt, how to choose the right approach for your situation, and tips to avoid falling back into debt.

Understanding Credit Card Debt

Before diving into strategies, let’s clarify what makes credit card debt particularly challenging:

- High Interest Rates: Most credit cards charge 18–25% APR, making balances grow quickly.

- Minimum Payments Trap: Paying only the minimum keeps you in debt for years and costs you thousands in interest.

- Multiple Cards: Managing different balances and due dates adds complexity and stress.

To successfully pay off your debt, you need a clear plan — not just good intentions.

Step 1: Assess Your Debt Situation

Start by listing all your credit cards with the following details:

- Current balance

- Interest rate (APR)

- Minimum payment

- Due date

Once you have the full picture, you can prioritize which debts to tackle first.

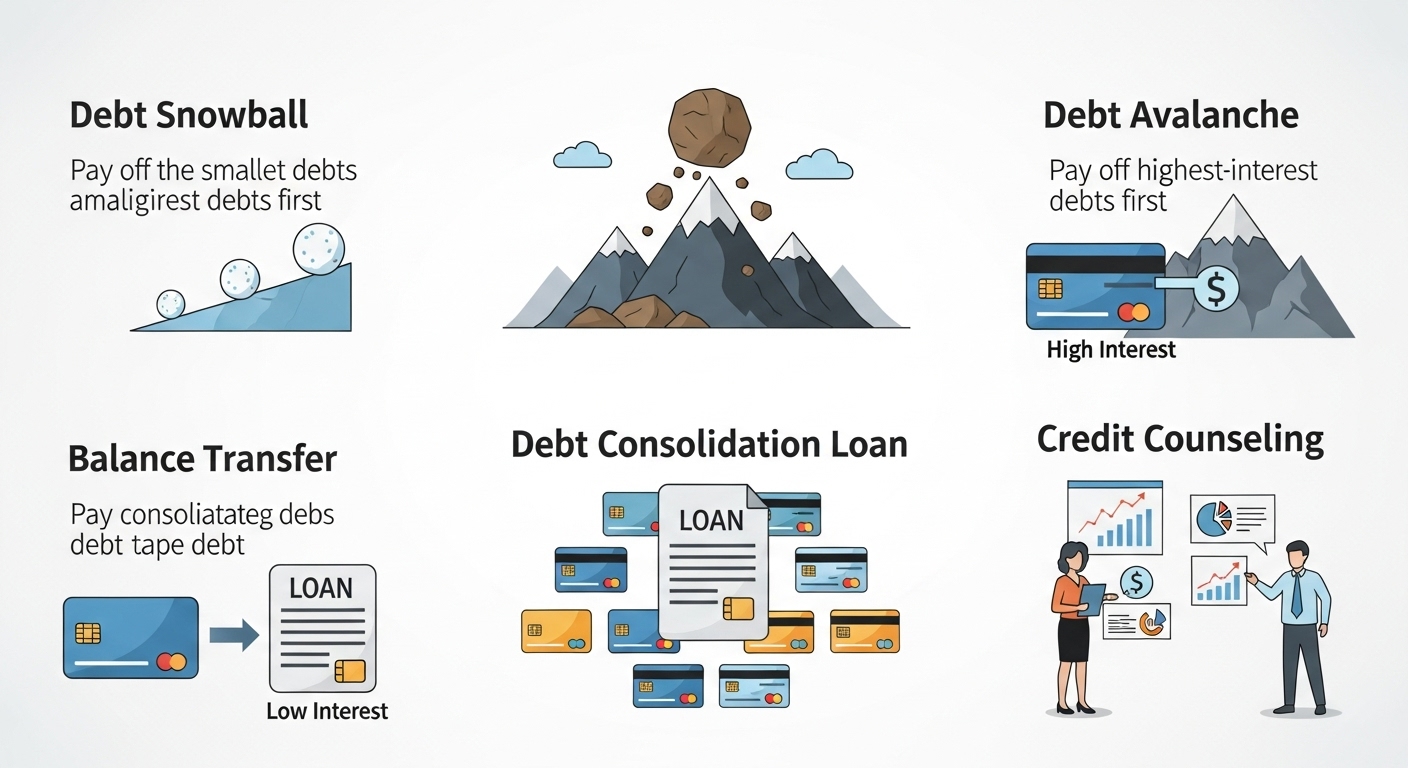

Step 2: Choose a Debt Payoff Strategy

There’s no one-size-fits-all method. The best strategy depends on your personality, financial situation, and motivation style. Below are the most effective approaches:

1. The Debt Snowball Method (Motivation-First Approach)

This strategy focuses on building momentum and motivation.

How it works:

- Pay the minimum amount on all your cards except the one with the smallest balance.

- Put any extra money toward the smallest debt until it’s paid off.

- Once it’s cleared, move on to the next smallest.

Why it works:

It gives you quick wins and psychological motivation to keep going — a great option if you struggle with staying consistent.

Best for:

People who need visible progress and emotional motivation.

2. The Debt Avalanche Method (Interest-First Approach)

This method minimizes how much you pay in interest.

How it works:

- Pay the minimum on all debts.

- Focus all extra money on the card with the highest interest rate.

- After paying it off, target the next highest interest rate, and so on.

Why it works:

You’ll save the most money and pay off debt faster compared to other methods.

Best for:

People who are financially disciplined and motivated by math and efficiency.

3. The Balance Transfer Strategy

If you have good credit, you can transfer high-interest balances to a 0% APR balance transfer card.

How it works:

- Apply for a balance transfer credit card offering 0% interest for 12–21 months.

- Transfer your existing balances to the new card.

- Pay down the debt aggressively during the 0% period.

Why it works:

You can save hundreds (or thousands) in interest — but it only works if you don’t add new charges.

Best for:

People with good credit and the ability to pay off debt within the promotional period.

4. The Debt Consolidation Loan

Combine all your credit card balances into one lower-interest personal loan.

How it works:

- Apply for a debt consolidation loan.

- Use the funds to pay off all your credit cards.

- Then, make one fixed monthly payment toward the new loan.

Why it works:

Simplifies payments and reduces interest, helping you pay off debt faster.

Best for:

People with multiple cards and a strong credit score.

5. The Budget & Expense Cut Strategy

Sometimes, the fastest way to pay off debt isn’t about new financial products — it’s about freeing up cash.

How it works:

- Track your expenses for a month.

- Identify unnecessary spending (e.g., subscriptions, dining out, impulse buys).

- Redirect that money toward your credit card payments.

Why it works:

Every dollar saved is a dollar closer to being debt-free.

Best for:

Anyone who needs to create financial breathing room and develop better habits.

Step 3: Stay Consistent and Track Progress

Consistency is key. Here are a few tools and habits that help:

- Use apps like Mint, YNAB, or Debt Payoff Planner to track progress.

- Set automatic payments to avoid late fees.

- Celebrate milestones (like paying off your first card).

- Check your credit score monthly to see improvements.

Step 4: Avoid Falling Back into Debt

Paying off your credit cards is only half the battle — staying out of debt is the real victory. Here’s how to keep it that way:

- Build an emergency fund (at least 3–6 months of expenses).

- Use credit cards wisely — pay in full each month.

- Avoid emotional spending or unnecessary upgrades.

- Review statements regularly for accuracy and spending patterns.

Example: How Small Changes Make a Big Difference

Let’s say you have $5,000 in credit card debt at 20% APR and pay $150/month.

- It would take over 5 years to pay off, and you’d pay $3,400 in interest!

But if you increase your monthly payment to $250,

- You’d be debt-free in just over 2 years, saving $2,200 in interest.

Small adjustments can lead to huge savings.

Final Thoughts

Paying off credit card debt takes time, effort, and commitment — but it’s absolutely achievable. Whether you prefer the Snowball Method for quick wins or the Avalanche Method for maximum savings, the key is to start now and stay consistent.

Remember: every payment you make is a step closer to financial freedom.

Summary: Best Credit Card Debt Payoff Strategies

| Strategy | Focus | Best For | Key Benefit |

|---|---|---|---|

| Debt Snowball | Smallest debt first | Emotional motivation | Quick wins |

| Debt Avalanche | Highest interest first | Logical savers | Save more on interest |

| Balance Transfer | 0% APR offer | Good credit holders | Lower interest costs |

| Debt Consolidation Loan | Single payment | Multiple debts | Easier management |

| Budget Strategy | Reduce expenses | Anyone | More money to pay debt |