How to Shop with Credit Card Installments

Shopping with credit card installments has become increasingly popular, allowing consumers to make larger purchases more manageable by spreading payments over several months. Whether you’re buying electronics, furniture, or planning a vacation, understanding how installment shopping works can help you make smarter financial decisions.

What Are Credit Card Installments?

Credit card installment plans allow you to divide a purchase into equal monthly payments over a predetermined period, typically ranging from 3 to 24 months. Instead of paying the full amount upfront, you pay a fixed amount each month until the total is settled.

Key Benefits

- Budget-friendly: Makes expensive items more affordable by spreading costs

- Predictable payments: Fixed monthly amounts make budgeting easier

- Interest-free options: Many retailers offer 0% interest installment plans

- Preserve cash flow: Keep money available for other expenses or emergencies

- Build credit history: Regular, on-time payments improve your credit score

How Credit Card Installment Shopping Works

Step 1: Check Your Credit Card’s Installment Options

Not all credit cards offer installment features. Contact your bank or check your online banking portal to see if your card supports:

- Point-of-sale installments at participating retailers

- Post-purchase installment conversions

- Cash advance installment options

Step 2: Choose Your Purchase

When shopping online or in-store, look for products that display installment payment options. Many retailers prominently feature installment plans with messages like:

- “Pay in 3 interest-free installments”

- “0% interest for 12 months”

- “Divide into 6 equal payments”

Step 3: Select Your Installment Plan

At checkout, you’ll typically see several installment options:

- Short-term plans (3-6 months): Smaller monthly payments, quicker payoff

- Medium-term plans (9-12 months): Balanced approach for moderate purchases

- Long-term plans (18-24 months): Lowest monthly payments for large purchases

Consider the total cost, including any interest or fees, when choosing your plan.

Step 4: Complete the Purchase

During checkout:

- Select “Installment Payment” as your payment method

- Choose your preferred installment period

- Review the payment schedule showing monthly amounts and dates

- Confirm the terms and complete your purchase

- Receive confirmation with your installment details

Step 5: Track Your Payments

After purchase:

- Set up automatic payments to avoid missing installments

- Check your credit card statement each month to verify the installment charge

- Keep track of remaining payments and balance

- Note the final payment date

Types of Credit Card Installment Plans

Interest-Free Installments

Many retailers partner with banks to offer promotional 0% interest installments. These are ideal for major purchases as you pay only the product price with no additional charges.

Best for: Electronics, appliances, furniture, and high-ticket items

Standard Bank Installments

Your credit card issuer may offer installment conversion for any purchase above a certain threshold. Interest rates vary based on:

- Your credit score

- The installment period

- Your bank’s current rates

- Promotional offers

Retail Store Installments

Some stores offer their own installment programs:

- Store-branded credit cards with special installment rates

- Buy-now-pay-later partnerships with services like Klarna or Afterpay

- Flexible payment plans for loyal customers

Important Considerations Before Using Installments

Calculate the True Cost

Always check:

- APR (Annual Percentage Rate): Is interest being charged?

- Processing fees: Some plans charge setup or monthly fees

- Late payment penalties: Missing a payment can incur significant fees

- Total amount: Multiply monthly payment × number of installments

Understand the Terms

Read the fine print:

- Can you pay off early without penalty?

- What happens if you miss a payment?

- Does the plan affect your credit limit?

- Are there any hidden charges?

Assess Your Budget

Before committing:

- Ensure you can afford monthly payments comfortably

- Consider your other financial obligations

- Leave room for unexpected expenses

- Don’t overextend with multiple installment plans

Check Your Credit Limit

Installment purchases still count against your credit limit. If you have a $5,000 limit and purchase $2,000 on installments, you’ll only have $3,000 available credit until you pay down the installment balance.

Best Practices for Installment Shopping

1. Shop During Promotional Periods

Retailers often offer enhanced installment deals during:

- Holiday sales (Black Friday, Cyber Monday)

- End-of-season clearances

- Anniversary sales

- New product launches

2. Compare Offers

Don’t accept the first installment plan you see:

- Check multiple retailers for the same product

- Compare interest rates and fees

- Look for longer interest-free periods

- Consider total cost, not just monthly payment

3. Prioritize Interest-Free Options

Whenever possible, choose 0% interest plans. Even if you need a longer payment period, interest-free installments save you money over time.

4. Set Up Automatic Payments

Prevent missed payments by:

- Linking installments to your checking account

- Setting up auto-pay through your bank

- Creating calendar reminders a few days before due dates

5. Avoid Multiple Simultaneous Plans

Juggling several installment plans can lead to:

- Budget strain

- Missed payments

- Reduced available credit

- Financial stress

Keep it simple with one or two manageable plans at most.

Common Mistakes to Avoid

Ignoring Interest Rates

A “low monthly payment” can be misleading if high interest accumulates. A $1,000 purchase at 24% APR over 12 months actually costs $1,133.

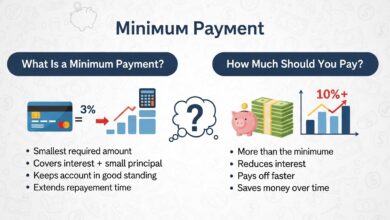

Paying Only Minimum Amounts

Some plans require only minimum payments but allow you to carry a balance. This extends your debt and increases total cost significantly.

Missing Payment Deadlines

Late payments can result in:

- Hefty late fees ($25-$40 typically)

- Loss of promotional 0% interest rate

- Negative impact on credit score

- Higher interest rates on remaining balance

Not Reading Terms and Conditions

Skipping the fine print may cause you to miss:

- Deferred interest clauses (where all interest charges if not paid in full)

- Automatic renewal terms

- Balance transfer restrictions

- Early payoff penalties

Overestimating Your Repayment Ability

Life circumstances change. Don’t commit to payments that leave no financial cushion for emergencies.

When Installment Shopping Makes Sense

Good Situations for Installments

- Essential large purchases: Replacing a broken appliance, necessary furniture

- Interest-free promotions: Taking advantage of 0% offers on planned purchases

- Cash flow management: When you have money coming but need the item now

- Credit building: Establishing positive payment history (if used responsibly)

When to Avoid Installments

- Impulse purchases: Don’t use installments to justify buying things you don’t need

- Depreciating items: Paying installments on items that lose value quickly

- Already in debt: Adding more debt when struggling with existing payments

- Uncertain income: When job security or income is unstable

Alternatives to Credit Card Installments

Consider these options:

- Saving first: Wait and save for the purchase (eliminates interest costs)

- Personal loans: May offer lower interest rates for large purchases

- 0% balance transfer cards: Transfer purchase to a card with promotional 0% APR

- Layaway programs: Some stores hold items while you make payments (no credit needed)

- Buy-now-pay-later services: Apps like Affirm, Klarna, or Afterpay (check terms carefully)

Tips for Managing Your Installment Purchases

Create a Payment Calendar

Track all your installment obligations:

- List each installment plan with monthly amounts

- Note payment due dates

- Calculate total monthly installment burden

- Update as you complete plans

Monitor Your Credit Utilization

Keep your credit utilization below 30% of your total limit. High utilization can negatively impact your credit score, even if you’re making timely installment payments.

Review Statements Regularly

Check monthly statements for:

- Correct installment charges

- Accurate remaining balance

- Any unexpected fees

- Progress toward payoff

Plan for Early Payoff

If your situation improves financially:

- Pay off installments early (if no penalty)

- Reduce interest charges

- Free up credit limit

- Eliminate monthly obligations

Conclusion

Credit card installment shopping can be a powerful financial tool when used wisely. It provides flexibility to make necessary purchases while managing cash flow effectively. The key is to approach installments strategically—choosing interest-free options when possible, understanding all terms, and ensuring the monthly payments fit comfortably within your budget.

Remember: installments are a payment method, not an excuse to overspend. By following the guidelines in this article, you can leverage installment shopping to make smart purchases that enhance your life without compromising your financial health.

Always read the terms carefully, compare offers, and most importantly, only commit to installment plans you’re confident you can fulfill. With responsible use, credit card installments can help you access the products and services you need while maintaining financial stability.