What Is a Minimum Payment? How Much Should You Pay?

Managing credit cards and loans can be confusing — especially when it comes to understanding terms like “minimum payment.” Many people see this amount on their statement and assume it’s enough to stay on track. While that’s technically true, only paying the minimum can lead to higher interest charges and long-term debt.

In this post, we’ll break down what the minimum payment is, how it’s calculated, and what you should pay to stay financially healthy.

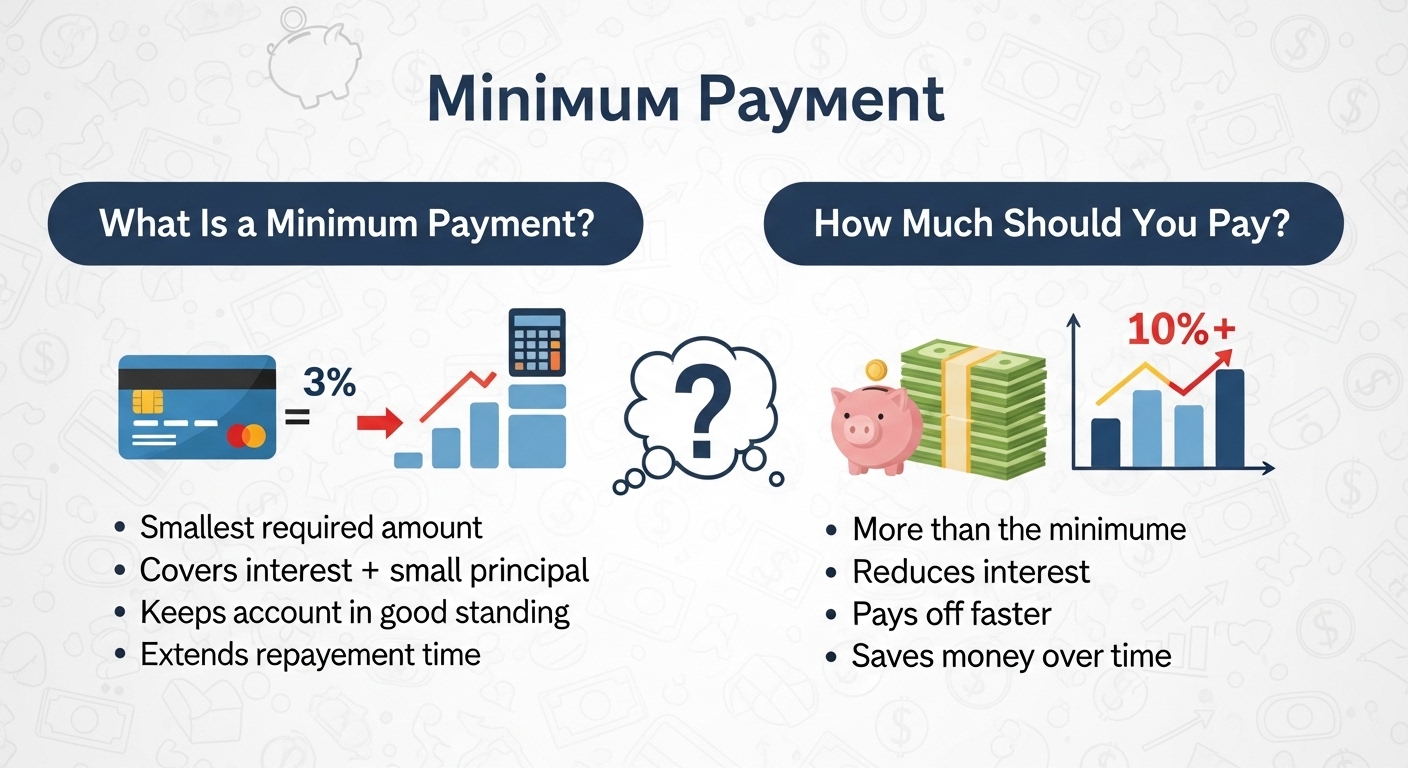

What Is a Minimum Payment?

The minimum payment is the smallest amount of money you must pay on your credit card or loan by the due date to keep your account in good standing. Paying at least this amount prevents:

- Late fees

- Negative marks on your credit report

- Increased interest rates due to late payments

However, making only the minimum payment means you’ll still owe most of your balance — and you’ll continue to pay interest on the remaining amount.

How Is the Minimum Payment Calculated?

The formula varies by bank or credit card issuer, but it usually includes:

- A small percentage of your total balance (commonly 1% to 3%)

- Interest charges for that billing cycle

- Any fees such as late or over-limit fees

For example:

If your balance is $1,000, and your minimum payment is 3%, your payment would be around $30. But if interest and fees are added, the actual minimum could be closer to $40–$50.

What Happens If You Only Pay the Minimum?

Paying only the minimum may seem convenient, but it can cost you hundreds or even thousands of dollars over time. Here’s why:

- Interest keeps accumulating on the unpaid balance

- Debt payoff takes much longer

- You could get stuck in a minimum payment cycle, paying mostly interest rather than reducing your principal balance

Example:

If you owe $2,000 at an interest rate of 20% APR, and you only pay the $40 minimum each month, it could take you over 15 years to pay off the debt — and you’d pay more than $2,000 in interest!

How Much Should You Pay Instead?

Ideally, you should pay the full balance each month to avoid interest altogether.

If that’s not possible, try to:

- Pay more than the minimum (at least double, if you can)

- Focus on paying off high-interest debts first

- Avoid making new purchases until your balance is under control

Even paying $20–$30 more than the minimum each month can significantly reduce the total interest you pay and shorten your repayment period.

Key Takeaways

- The minimum payment keeps your account in good standing but doesn’t reduce your debt effectively.

- Paying only the minimum can lead to long-term interest costs and debt traps.

- Whenever possible, pay more than the minimum — even small extra payments make a big difference.

Final Thoughts

Understanding your minimum payment is crucial for managing debt wisely. While it might be tempting to pay the smallest amount due, remember that this strategy benefits the bank more than you.

To build financial freedom, pay as much as you can afford each month, stay mindful of your interest rates, and keep your balances low.